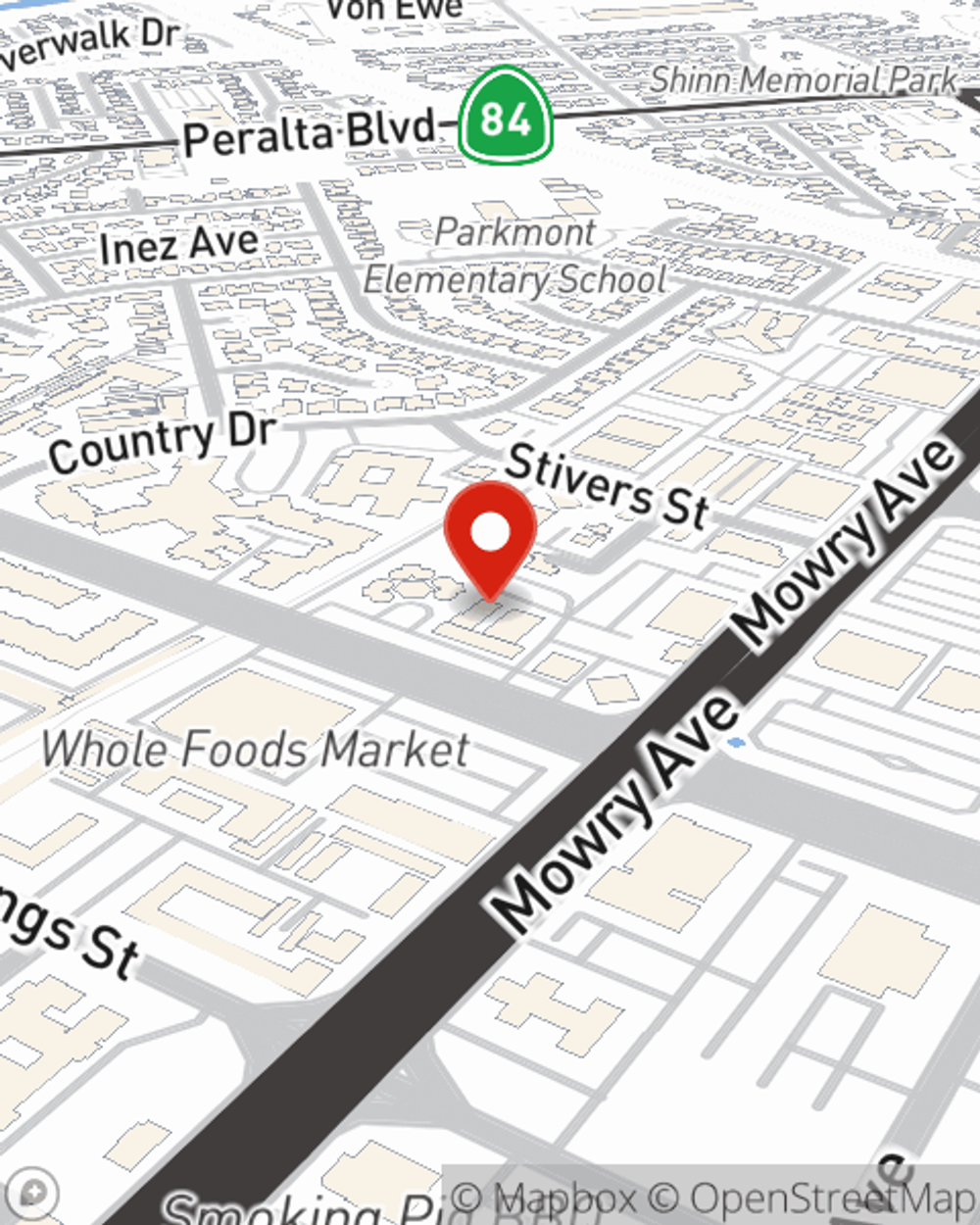

Life Insurance in and around Fremont

Get insured for what matters to you

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

When it comes to high-quality life insurance, you have plenty of choices. Evaluating riders, providers, coverage options… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Chris Hur is a person with the knowledge needed to help you build a policy for your specific situation. You’ll have a hassle-free experience to get budget-friendly coverage for all your life insurance needs.

Get insured for what matters to you

Now is a good time to think about Life insurance

Fremont Chooses Life Insurance From State Farm

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the worst comes to pass, Chris Hur is waiting to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

To find out your Life insurance options with State Farm, get in touch with Chris Hur's office today!

Have More Questions About Life Insurance?

Call Chris at (510) 791-8611 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Simple Insights®

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.